I’ve been collecting news articles and running natural language processing (NLP) and machine learning (ML) on them for a while.

I noticed that publicly traded companies heavily use PR to help increase their stock price. This lead me to thinking that maybe there’s a correlation between media sentiment and stock price.

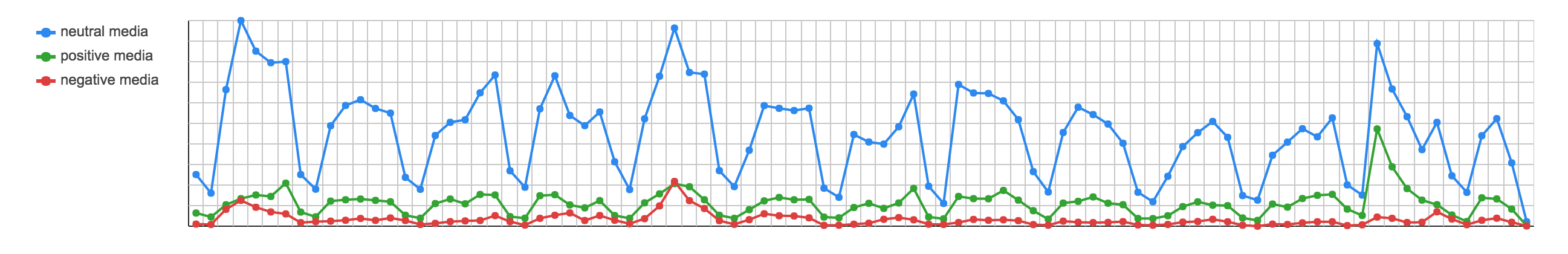

I took the 90 day sentiment analysis for Apple (APPL) from my analytics engine and on this overlaid the closing price of the stock. Visually I could see a correlation.

- unfortunately I can’t overlay the stock closing data on sentiment as it breaks the data usage rights (can’t be reprinted in any form).

I then wrote a quick node.js program to run over all the NASDAQ listed stocks and correlate closing price with overall sentiment direction. From this I discovered most of the listed stocks don’t have enough media mentions to merit the volume of data needed to run the math. For the big stocks, there are definite correlations, most with a 1 day or same day lead time, a few like Apple/Google/Twitter that would give a 2 day buy/sell indicator.

My conclusion from this experiment is that large public companies that consumers have a passion for are heavily traded by the public and because of this media sentiment heavily affects the direction of stock as the news reaches the consumer investors.